Understanding IRMAA and How to Avoid a Surprising Surge in Medicare Premiums

Imagine this: You’re about to turn 65 and are excited to switch from private health insurance to Medicare, expecting to save money. But instead, you’re hit with a significant increase in your Medicare premiums. This has become a reality for many of our clients.

In one recent situation, a married couple who had both turned 65 faced unexpectedly high monthly premiums due to something called the Medicare Income Related Monthly Adjustment Amount, or IRMAA. This increased their monthly Medicare premiums above what they were expecting to pay by almost $1,000 or $12,000 for the year! Fortunately, we were able to help them eliminate these costs. Here’s how you can avoid a similar surprise and manage your Medicare premiums effectively.

What is IRMAA?

The Income-Related Monthly Adjustment Amount, IRMAA, is an extra charge added to Medicare premiums for individuals and couples with higher incomes. If your income exceeds specific thresholds, you’ll pay more for Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage).

What Triggers IRMAA?

IRMAA is determined based on your income from two years prior. For instance, your income in 2022 will affect your Medicare premiums in 2024, your income in 2024 will affect your Medicare premiums in 2026, and so on. The thresholds for IRMAA are set annually and can lead to increased premiums if your income surpasses these limits. This means you might face higher costs even if your financial situation has since changed.

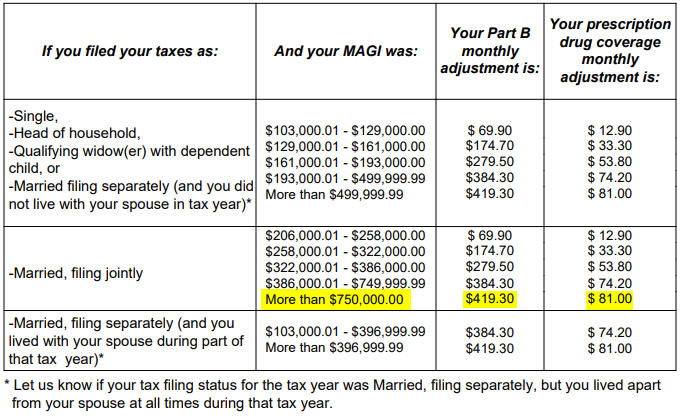

As shown in the table below, the IRMAA charge is based on Modified Adjusted Gross Income, or MAGI, reported annually on your tax return. Because our clients sold their home the year they retired, their MAGI went from just over $200,000 to well over the $750,000 cap shown in the table. This caused their Medicare Part B and Part D premiums to increase by $419.30 and $81.00, respectively. More details on their story are in the following sections.

What is Form SSA-44?

The Social Security Administration’s (SSA) Form SSA-44, officially titled “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event,” is a document you can use to request a reduction in your IRMAA if you experience a significant life event that impacts your income. This form helps ensure that your Medicare premiums reflect your current financial situation rather than outdated income levels. It also allows you to report changes affecting your income and request an adjustment to your Medicare premiums.

Life-Changing Events

The following eight life-changing events listed in Form SSA-44 may qualify you for relief from IRMAA premiums:

Marriage

Divorce/Annulment

Death of Your Spouse

Work Stoppage

Work Reduction

Loss of Income-Producing Property

Loss of Pension Income

Employer Settlement Payment

How to File Form SSA-44

Filing Form SSA-44 involves several steps:

1) Obtain the Form: You can download Form SSA-44 from the Social Security Administration (SSA) website or pick it up from your local SSA office.

2) Complete the Form: Follow the included directions to enter your personal information, describe the life-changing event that affected your income, and include documentation to support your claim. This might include divorce decrees, death certificates, or retirement letters.

3) Submit the Form: You can either bring the form and supporting documents to your local SSA office, or you can mail everything in. Based on the experience of many of our clients, we’d recommend making an appointment and bringing everything in personally. Either way, be sure to keep copies of all the paperwork for your records.

4) Await Review: The SSA will review your application and notify you of their decision regarding any adjustments to your IRMAA. Sometimes this takes the form of a refund, and other times, the SSA reduces subsequent Medicare premiums until the overpaid amount has been fully offset.

A Success Story: Reversing the Premium Surprise

Let’s dive into a real-world example to see how Form SSA-44 can make a difference. This is the story of our clients, who had just turned 65 and faced an unexpected increase in their Medicare premiums:

The Situation:

Our clients were looking forward to the transition to Medicare, anticipating a reduction in their health insurance costs. However, their expectations were shattered when they saw significantly higher premiums than they had planned for, due to IRMAA. At age 63 in 2022, they retired and sold their home, which caused their Adjusted Gross Income (AGI) to jump from about $200,000 to well above $750,000, the highest IRMAA tier. This dramatic increase in income pushed them into the highest IRMAA bracket for 2024, as shown in the table above.

Because IRMAA is based on income from two years earlier, their increased AGI led to an additional $419.30 per month for Medicare Part B and $81.00 per month for Medicare Part D prescription drug coverage for both spouses. This added up to an extra $1,000 monthly or $12,000 annually for both spouses.

The Solution:

Our clients felt overwhelmed by the higher costs and reached out to us for help. We stepped in to assist them with Form SSA-44. We provided guidance on how to fill out the form, including gathering the necessary documentation to reflect their changed financial situation. In this case, they just needed to provide tax returns and documentation that they retired (to show that their income had gone down as a result).

After submitting the form, the SSA reviewed their application and approved the adjustment. This decision reduced their IRMAA and saved them the entire $12,000 in additional Medicare premiums.

This is an extreme example because the change in income was so large due to the sale of their home. However, we’ve had many other situations where one or both spouses had income that put them in a high IRMAA bracket before retiring, and we were still able to get them a reduction in their IRMAA premiums. Even though the savings weren’t as great as in the example above, they were still happy to get the reduction.

Tips for Managing Your IRMAA

IRMAA adjustments may apply to anyone age 65 and above, but remember that your income at age 63 affects your Medicare premiums at age 65. To avoid unexpected IRMAA charges, consider the following strategies:

1) Plan Your Withdrawals: If you’re close to reaching an IRMAA threshold, opt for withdrawals from Roth IRA accounts or trust accounts rather than Traditional IRAs to keep your AGI lower. Each withdrawal from a Traditional IRA or 401(k) is considered taxable income, which increases your AGI and potentially moves you into a higher IRMAA tier.

2) Plan Your Charitable Contributions: Use Qualified Charitable Distributions (QCDs) from your IRA to reduce your Required Minimum Distributions (RMDs) and AGI.

- This year, a qualified charitable distribution allows those who are age 70½ and above to donate up to $105,000 total to one or more charities from their IRA instead of taking their required minimum distributions.

- Any QCDs will reduce the tax impact of your RMDs, which are treated as ordinary income for tax purposes.

- QCDs also eliminate the donated amount from taxable income, contrary to RMDs and regular IRA withdrawals.

- It wouldn’t necessarily make sense to make a QCD solely to reduce one’s tax bill. However, it’s something to consider for high-income taxpayers who are already making charitable contributions, as this could minimize Medicare IRMAA premiums.

3) Retirement Contributions: If you’re still working, you can make tax-deductible contributions to your Traditional 401(k) or Traditional IRA to lower your AGI.

If you’re approaching retirement or have recently experienced a life-changing event, keep an eye on your AGI and the potential impact on your Medicare premiums. Proactively managing these factors can help you avoid surprises and ensure your Medicare costs remain manageable.

Need Assistance?

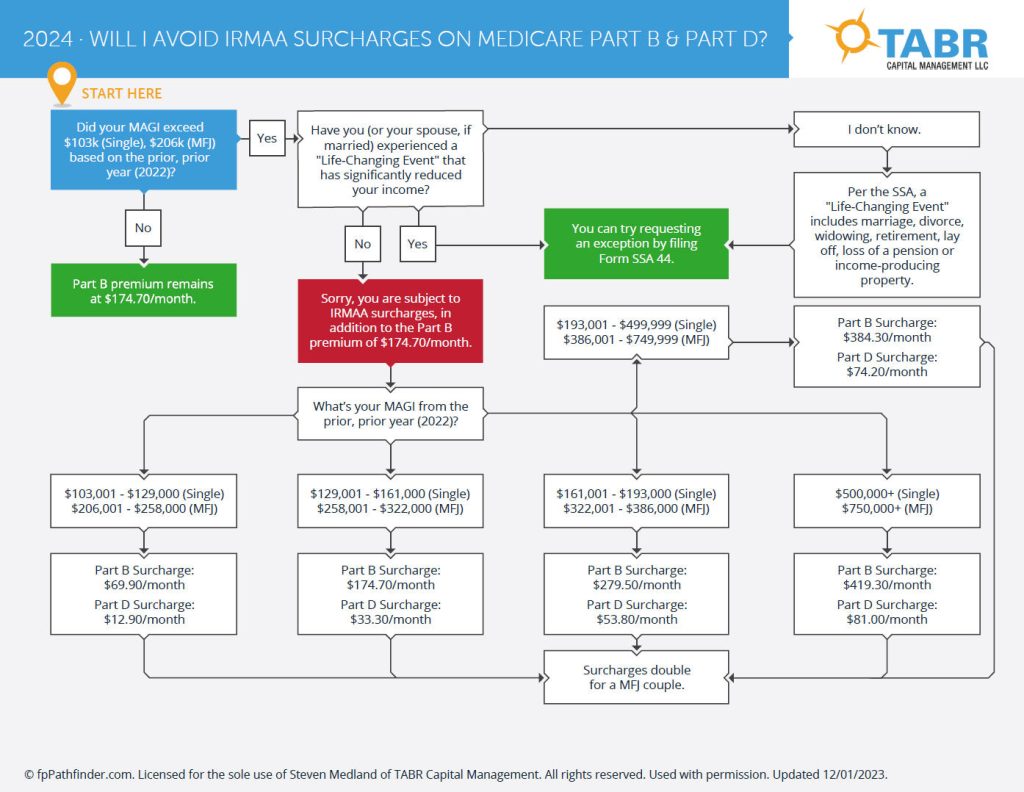

If you have questions about IRMAA or need help with Form SSA-44, please reach out to us. We’ve successfully assisted many clients in navigating these issues and are here to help you too. Call or email us to discuss how we can help you manage your Medicare costs effectively. You’re also welcome to explore the flowchart below, which will help you determine whether or not you’re subject to IRMAA surcharges and how to potentially eliminate them.

Why Keeping Your Long-Term Care Insurance Might Be One of the Best Financial Decisions You Can Make

Navigating financial decisions often involves making choices that might seem small in the moment but can have significant impacts on your future. One such choice involves long-term care insurance (LTCI), a crucial but often misunderstood aspect of financial planning.

Last month, Bob Kargenian sent me a Barron’s article, Long-Term Care Insurance Rates Are Soaring. How One Couple Is Coping, which highlighted the dramatic increase in LTCI rates. The soaring costs are causing many to reconsider their coverage, and this brings me to an interesting story about one of our clients.

The Rising Tide of Long-Term Care Insurance Costs

The Barron’s article paints a stark picture of today’s long-term care insurance market. As the costs for new LTCI policies rise steeply, many individuals face premiums that are far beyond what was expected. This surge has many reasons, including longer life expectancies, rising healthcare costs, and increased claims.

In light of this, I’ll share the story of clients who recently experienced the benefits of maintaining their long-term care insurance policies despite the temptation to cancel them.

The Clients’ Dilemma

Two years ago, one of our clients in her 80s approached us with a decision that many people in her position might grapple with. She and her husband, who had been faithfully paying their LTCI premiums for years, felt that the premiums were becoming too much of a financial burden after getting yet another notice that the premiums would increase. They were considering canceling their existing policies and getting replacement policies to hopefully save money.

However, Bob and I knew that all LTCI premiums were increasing and that newly issued policies would likely cost even more than their existing ones. We reached out to the LTCI specialist we know at Low Load Insurance Services (LLIS), and he researched the options.

The Research and Results

After the analysis, we discovered that canceling the existing policies would have been a significant financial mistake. Here’s why:

1) Premium Increases: The research revealed that if they canceled their current policies, they would face substantially higher premiums for new ones. The increase was due to the overall rise in LTCI rates and the fact that premiums are generally higher for new policies, especially as the insured ages.

2) Coverage Gaps: They risked potential coverage gaps by canceling their current policies. If they were to reapply, there was no guarantee that they would qualify for coverage with comparable terms, given their age and the stringent underwriting standards for new policies.

3) Cost Efficiency of Existing Policy: Their existing policies had certain benefits that were no longer available in new policies. This included lower base rates locked in at a time when LTCI costs were more favorable.

The Outcome

Our contact at LLIS confirmed that even after the premium increase in their existing policies, they would pay significantly more by canceling those policies and getting new ones. She and her husband reconsidered their decision and opted to continue paying the premiums.

Fast forward to last month, when she called and said how grateful she was for that decision. Her husband is now dealing with Alzheimer’s and requires help from an in-home caregiver eight hours per day, four days per week.

Her husband’s long-term care insurance is now reimbursing them for all of their in-home care expenses, which costs them $4,200 per month now and is likely to increase as the Alzheimer’s progresses.

The Takeaways

Our clients’ experience underscores a critical point for anyone holding a long-term care insurance policy: keeping your existing policy can often be a far better financial decision than canceling and purchasing a new one. With LTCI rates soaring, maintaining your current coverage can safeguard you against unprecedented costs and provide valuable protection in the future.

However, there’s not a one-size-fits-all solution. We have other clients who faced a 90% increase in their LTCI premiums, and as a result, a successful class action lawsuit gave them the option to get tens of thousands of dollars of the premiums refunded to them. In their case, they decided that the best decision was to cancel the policy and take the refund.

Also, for those who don’t currently have an LTCI policy, getting one at this point may not be the best option due to the higher cost of premiums today. In the last several years, whenever we’ve requested LTCI quotes for clients, the response has almost always been the same. “What?! For that much money, I’d be better off investing that amount each month and just paying for long-term care expenses out of pocket later, if necessary.” In other words, many of our clients have opted to self-insure, given the new LTCI landscape.

The only way to know for sure what’s best in your situation is to do the research. If you have any questions or are considering buying or canceling long-term care insurance, I encourage you to reach out. We can review your options and help you make the best decision for you and your family.

Social Security News

In our most recent quarterly report cover letter, I wrote about some interesting developments regarding Social Security.

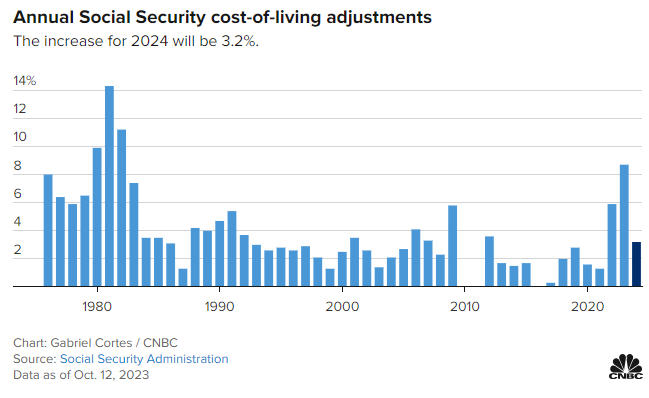

2025 COLA

The first update is that the most recent Social Security Cost of Living Adjustment (COLA) estimate for

2025 is 2.7% due to the Consumer Price Index (CPI) data released on July 11 coming in lower than

expected. The lower inflation numbers are considered good news for the economy because prices

aren’t increasing as much as they were a year ago, and lower inflation also increases the chance that

the Federal Reserve will cut interest rates in September.

The 2024 Social Security COLA was 3.2%, so the current 2.7% estimate for 2025 is half a percent

lower than last year’s. The final 2025 COLA number could be more or less than 2.7%, depending on

the average inflation rate during the 3rd quarter of 2024, which will then be compared to inflation

during the 3rd quarter of 2023.

For historical reference, the Social Security COLAs from the mid-1970s through 2024 are shown in the chart below, courtesy of CNBC:

New Login Requirements

The second update is that the Social Security Administration (SSA) will soon require a Login.gov or

ID.me account to log in to your online Social Security account at https://www.ssa.gov/. According to the SSA, millions of account holders are already using Login.gov or ID.me to log in, and you won’t need to take any action if you’re already doing that.

For those who are curious, Login.gov and ID.me both provide account access to websites for government benefits and services. The primary difference between the two is that Login.gov is run by the government, whereas ID.me is a third-party service provider.

The SSA has said that this change will simplify the sign-in experience and align with federal

authentication standards to provide safe and secure access to the SSA online services.

If you are still logging into the Social Security website using your Social Security username and

password, you’ll need to set up your new login credentials. To do that, click “Sign in” at the top of the

SSA website and then “Sign in with Social Security Username.” After signing in, you will be asked to

create an account with Login.gov, which has 24/7 customer phone and chat support. The customer

support team can be used to answer your questions and help you create your account if necessary.

I set up my Login.gov access on the SSA website and can now log in without any issues. It took about

5 minutes, including the time to set up 2-factor authentication using my cell phone texts. Another advantage of Login.gov is that it eliminates the need to remember multiple passwords and usernames for various government websites. I recently used Login.gov credentials to renew my TSA Precheck and Global Entry membership, so there are other advantages to setting it up.

Current Investment Allocations

After Bob Kargenian wrote our previous monthly update four weeks ago, we went from 80% invested in our stock allocations to 100% on July 12. Last week, one of our models went on a sell signal, and we went back to 80% invested. Four out of five of our investment models are again positive, and our high yield bond tactical model is still on its November BUY signal.

Although our indicators are mostly positive at the moment, we’re entering into August and September, usually two of the weaker months for the stock market. Regardless, we will follow the evidence and be ready to reduce or increase our stock exposure as necessary in the coming months.

Midway Through Summer

Summer has flown by so far. In our newsletter last fall, I included pictures of Audrey and Conrad on our vacation to Italy, when Audrey was a few inches taller than Conrad. In the pictures below, it’s just the opposite. The photo on the left is from our camping trip up the California coast this spring, and the two on the right are from our vacation in Mallorca and Barcelona last month.

It’s hard to believe Audrey is going to be a high school senior and Conrad is going to be a high school junior starting next month. How did that happen so fast?

I hope you are enjoying your summer. As mentioned above, please reach out if you have any questions. And thank you, as always, for your continued trust and confidence.

Best regards,

Steven W. Medland, MBA, CFP®

Partner

TABR Capital Management, LLC (“TABR”) is an SEC registered investment advisor with its principal place of business in the state of California. TABR and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisors by those states in which TABR maintains clients. TABR may only transact business in those states in which it is notice filed, or qualifies for an exemption or exclusion from notice filing requirements.

This newsletter is limited to the dissemination of general information pertaining to our investment advisory/management services. Any subsequent, direct communication by TABR with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of TABR, please contact TABR or refer to the Investment Advisor Disclosure web site (www.adviserinfo.sec.gov).

The TABR Model Portfolios are allocated in a range of investments according to TABR’s proprietary investment strategies. TABR’s proprietary investment strategies are allocated amongst individual stocks, bonds, mutual funds, ETFs and other instruments with a view towards income and/or capital appreciation depending on the specific allocation employed by each Model Portfolio. TABR tracks the performance of each Model Portfolio in an actual account that is charged TABR’s investment management fees in the exact manner as would an actual client account. Therefore the performance shown is net of TABR’s investment management fees, and also reflect the deduction of transaction and custodial charges, if any.

Comparison of the TABR Model Portfolios to the Vanguard Total Stock Index Fund, the Vanguard Total International Stock Fund, the Vanguard Total Bond Index Fund and the S&P 500 Index is for illustrative purposes only and the volatility of the indices used for comparison may be materially different from the volatility of the TABR Model Portfolios due to varying degrees of diversification and/or other factors.

Past performance of the TABR Model Portfolios may not be indicative of future results and the performance of a specific individual client account may vary substantially from the composite results above in part because client accounts may be allocated among several portfolios. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable

For additional information about TABR, including fees and services, send for our disclosure statement as set forth on Form ADV from us using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

A list of all recommendations made by TABR within the immediately preceding one year is available upon request at no charge. The sample client experiences described herein are included for illustrative purposes and there can be no assurance that TABR will be able to achieve similar results in comparable situations. No portion of this writing is to be interpreted as a testimonial or endorsement of TABR’s investment advisory services and it is not known whether the clients referenced approve of TABR or its services.