The Future of AI in Financial Planning

With NVIDIA Corporation nearly tripling its stock price so far in 2024 and surpassing Apple as the world’s most valuable company, there’s never been more interest in artificial intelligence (AI). Although NVIDIA isn’t an AI company per se, it supplies AI companies with critical infrastructure like graphics processing unit (GPU) chips.

With this growing interest in AI and the continuing rapid evolution of technology, some have started to wonder if artificial intelligence will replace humans in various career roles, including financial planners.

While the short answer for financial planners is no, AI is already making significant strides in transforming the financial planning industry. As a financial planner, I’ve started using AI tools like ChatGPT to improve the accuracy and efficiency of my financial planning knowledge, with the caveat that I have to verify the accuracy with other sources.

These tools help me quickly review financial topics, ensure I cover all relevant points, and even streamline my work when researching newsletter topics. Beyond assisting in these areas, AI is now entering the realm of tax and estate planning—areas where it’s making a real impact.

In today’s post, we’ll explore how AI is reshaping financial planning, where it excels, and where it still falls short. We’ll dive into some exciting innovations, such as Google’s NotebookLM, a research assistant with mind-blowing capabilities. We’ll also cover Holistiplan’s tax planning software, which uses groundbreaking AI-driven tools focused on tax savings and estate planning.

Finally, we’ll discuss the implications of the US election on your investments and our current investment allocations, so read on.

Which of These Podcast Hosts is Human?

I recently learned of Google’s NotebookLM research tool, which is designed to synthesize and summarize information from many different sources like video, audio, text, etc., and provide you with instant insights into the topics that interest you. One of NotebookLM’s game-changing capabilities is creating a podcast based on its research.

I was intrigued and uploaded my book, Spiraling Up: Discover Financial Serenity, Make Work Optional, and Live Happily in Retirement, along with some other notes. It then created the podcast below, summarizing the key points of the book in an interesting back-and-forth between the podcast hosts. Even if you don’t have time to listen to the entire recording, click on the link below, listen to the first minute or two, and try to guess which of the podcast hosts is human.

Click here: Spiraling Up Podcast Recording

Okay, it was a trick question. The answer is that neither of the hosts are human. In fact, NotebookLM created the podcast in about 10 minutes using AI-generated voices, and it didn’t cost one penny to produce. Just amazing. With astounding capabilities like this already available for free, it makes you wonder about the future of AI in finance.

The Rise of AI in Financial Planning

Our clients are generally affluent individuals and couples who are retired or within a few years of retiring, and they’ve spent decades building wealth and carefully planning their financial future. They come to us for help navigating the complexities of taxes, retirement, investments, and estate planning. As interest in artificial intelligence has grown, some of our clients have understandably asked how the future of AI will affect their financial planning.

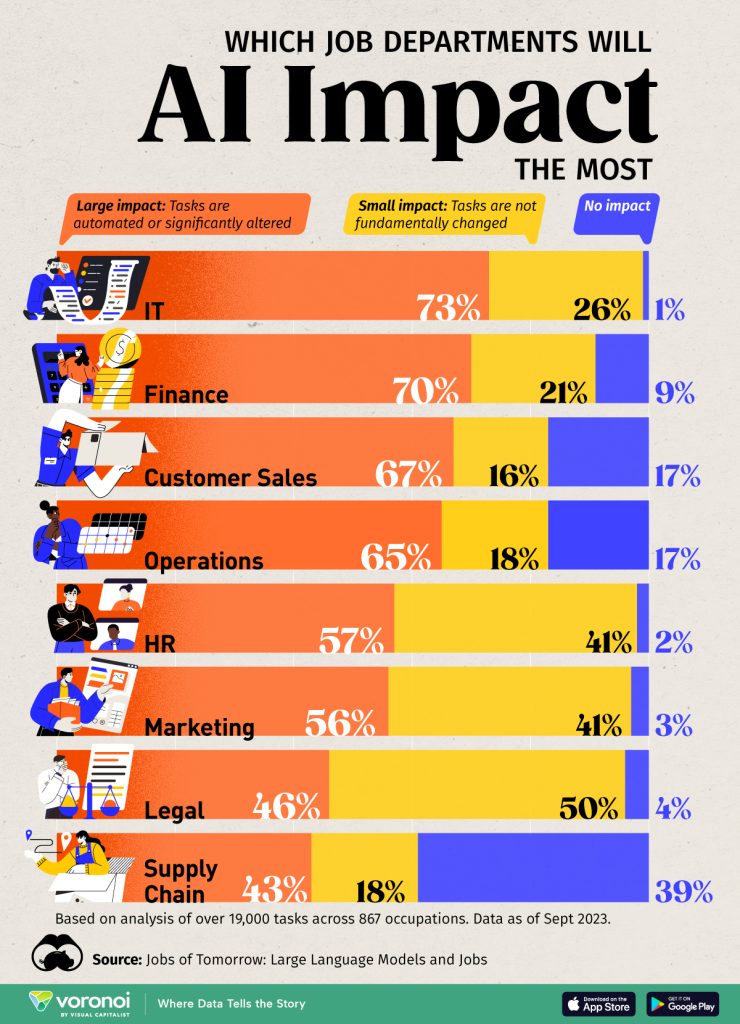

The chart below shows the types of jobs that AI will affect most, and the finance industry is second only to information technology (IT).

Artificial intelligence has made remarkable progress in the past few years. ChatGPT and similar tools can generate human-like responses to a wide range of questions, and their capabilities go well beyond simple chat functions. These tools can assist with basic questions, but beware when it comes to complex decision-making.

I’ve experimented by asking ChatGPT moderately complex questions about Social Security claiming strategies, and the answers were instant, extremely confident, and… completely wrong. While ChatGPT and other AI programs are great at providing a general overview of Social Security claiming strategies, most are unreliable regarding specific advice for real people trying to make decisions about their finances.

Still, some of the more advanced AI models are becoming integrated into the day-to-day workflows of financial planners. Although it’s not replacing human expertise, AI can be a powerful resource enhancing the work of financial planners by automating time-consuming tasks and providing insights that can help planners offer more comprehensive advice.

The Tax Revolution: Holistiplan and AI-Powered Tax Savings

One of the first major innovations in AI for financial planning came in 2019 with the launch of Holistiplan, a tax planning software that uses AI to scan tax returns and spot opportunities for tax savings. For financial planners, this has been a valuable tool. It reduces the time spent manually combing through a client’s tax documents and allows planners to uncover tax-saving strategies they may have missed otherwise.

Holistiplan uses AI to analyze tax returns and evaluate strategies like Roth conversions or minimize Medicare premiums (i.e., the Income Related Monthly Adjustment Amount, IRMAA, that I wrote about in the July 2024 newsletter). Increasing speed and accuracy allows financial planners to give better advice to their clients more efficiently.

Since its launch, Holistiplan has become a staple tool for some financial planners, allowing us to provide clients with better information. However, I would note that while AI has revolutionized this area of financial planning, tax laws, and strategies are constantly changing, so human expertise is still necessary to ensure that clients are getting the best advice based on the latest legal and tax rules.

A perfect example happened during an annual review just last week when we caught an error our client’s CPA made on their tax return. The CPA has already submitted an amended return, which will result in a $3,000 refund. As good as Holistiplan is, the software didn’t catch the error, highlighting the need for human collaboration.

The Next Frontier: Estate Planning and Holistiplan’s New Tool

Fast forward to last week, and Holistiplan made another significant announcement, the launch of a new estate plan document evaluation tool. This will allow financial planners to analyze their clients’ estate planning documents—such as wills, trusts, and powers of attorney—and automatically generate a client-friendly report that highlights the key components of their estate plan.

Although we haven’t had a chance to use it yet, the new tool will purportedly use AI to scan estate planning documents and output a streamlined summary of how an individual’s assets will be distributed after their death. It will also detail the named beneficiaries on retirement accounts and any assets that are designated for transfer upon death, such as life insurance policies or real estate. This AI-powered tool has the potential to save valuable time and reduce the chances of errors in interpreting critical information in these documents.

Of course, another caveat is in order. While AI can assist in distilling and organizing estate planning data, human financial planners still play a vital role in offering strategic advice. No AI can replace the nuanced understanding of your family dynamics, charitable giving preferences, or legacy goals.

AI’s Strengths and Weaknesses: Where It Excels and Where It Falls Short

Despite AI’s recent advances in financial planning, it still has limitations. According to a Wall Street Journal article, Can AI Replace Your Financial Adviser? Not Yet. But Wait., AI can excel in tasks like generating reports or identifying patterns in large datasets, but it’s not yet capable of replacing the nuanced advice provided by a human adviser. The article tackles several different aspects of AI versus human advice:

1. Debiasing and Behavior Management:

Financial planners can sometimes help clients avoid making emotional or biased decisions about their money. For example, during a market downturn, a good adviser can help a client avoid selling investments in a panic. However, AI systems are still prone to biases, such as overestimating risk after market losses, whereas a human adviser can step in to manage emotions and provide the necessary long-term perspective.

2. Empathy:

Another critical aspect of financial planning is the adviser’s ability to connect with clients emotionally. While AI can generate seemingly empathetic responses, it cannot truly understand and respond to the complex emotions that clients may experience when facing financial uncertainty or transitions like retirement. A good financial planner knows how to support clients during volatile market periods and tailor advice to their unique needs.

3. Accuracy and Reliability:

AI’s ability to generate financial advice is still hindered by its dependency on data quality. As I mentioned above, current AI tools like ChatGPT can make significant errors in financial analysis or offer incomplete or inaccurate recommendations if left unsupervised. This limitation only gets worse if the data they rely on is flawed. However, AI can be paired with human oversight to enhance the quality of advice if done correctly.

The Hybrid Future of Financial Planning

So, will AI ever replace financial planners? No, but financial planners who use AI will probably replace those who don’t.

It’s reminiscent of the time so-called robo-advisors like Wealthfront and Betterment became available to the public in 2008, offering software algorithms to manage investments at bargain prices without human intervention.

At the time, some industry pundits said the technology would replace human advisors, but consumers voted with their dollars and unequivocally chose to work with human advisors. What happened was that financial planners used the robo-advisor technology to become more efficient in serving clients.

Today’s AI tools are already enhancing the financial planning process, and they will continue to do so in the future. Financial advisers who use AI tools to complement their expertise are better equipped to offer personalized, proactive advice to their clients.

The future of financial planning is bright and most likely involves a hybrid model, where AI supports human advisers by streamlining time-consuming tasks and providing valuable insights. This collaboration allows advisers to focus on the strategic aspects of financial planning while using AI to help in certain areas. The end result will be a more efficient, accurate, and comprehensive financial planning process.

US Election Results and Your Investments

Republicans won control of the White House and Senate, but the fate of the House of Representatives is still unknown days after the election. The composition of the House will likely determine how effective the president will be in enacting his agenda.

As of today, Republicans hold 214 seats in the House, with Democrats holding 204. Republicans gained two seats that Democrats lost, and there are 19 races still to call, determining which party will receive the 218 seats required to become the majority party.

This relates to investments because President-Elect Trump wants to enact nearly $8 trillion in tax cuts that would only pass with control of both houses of Congress. Tax cuts from the 2017 Tax Cuts and Jobs Act will expire at the end of 2025, and extending those tax cuts along with the others will likely require a Republican majority in the House.

Stock market returns are based on the discounted cash flows of a company’s future profits. Lower taxes generally increase profits and result in higher stock prices. What significantly lower taxes would ultimately do to the country’s budget deficit, debt burden, and fiscal health is a topic for another day, but it’s likely that lower taxes will boost stocks in the shorter term.

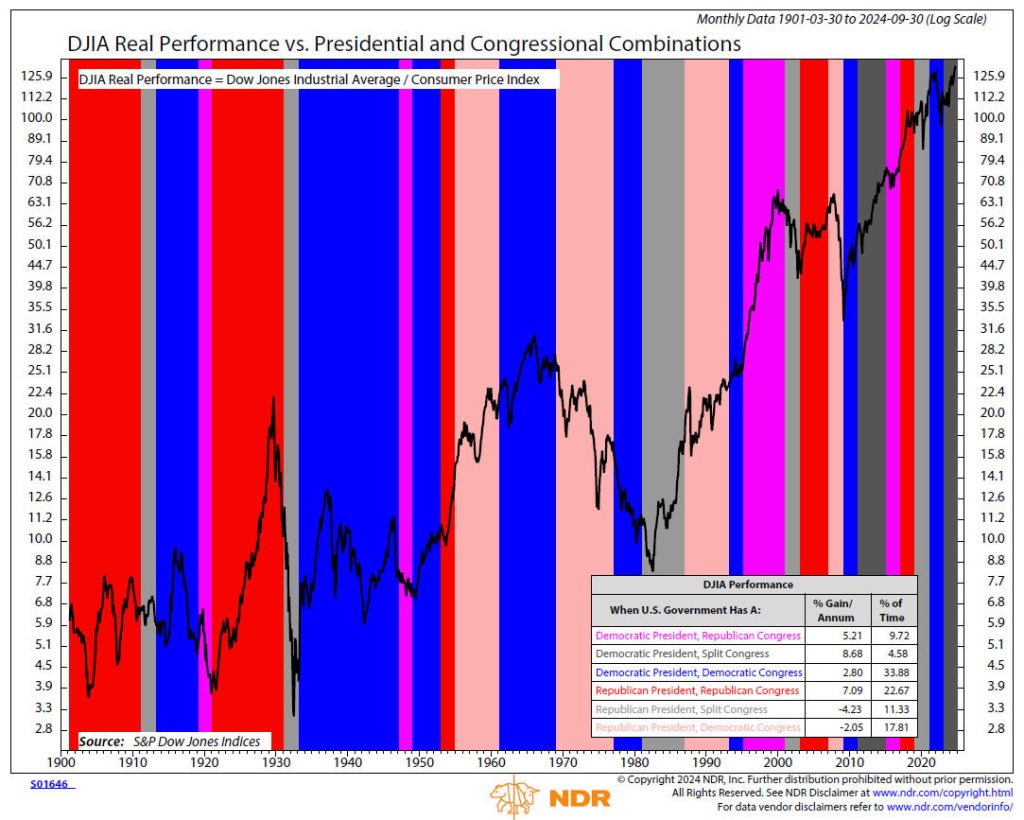

In the chart below, courtesy of Ned Davis Research, you’ll see the six possible presidential and Congressional political party combinations. Historically, the best combination has been a Democratic President with a split Congress, gaining 8.68% annually.

The second best combination is a Republican President with a Republican Congress, returning 7.09% annually. However, there is a stark difference when there is a Republican President with a split Congress, showing a -4.23% loss per year, the worst of any of the six combinations. Most of the remaining House races are leaning Republican, so the odds currently favor a Republican majority. We should know within the next few days which of these two scenarios we will have.

Regardless of the outcome, we will continue to follow our investment discipline. We have clients on both sides of the political divide, and some expressed a strong conviction that if their candidate didn’t win, the market would immediately crash. The fact is none of us know, which is why we’ve always emphasized our unemotional risk management approach.

TABR Investment Allocations

Since Bob Kargenian wrote the last update on October 10, our tactical accounts have maintained 83% equity exposure. We’ve been at this same allocation going on four months, and our high yield strategy is still on a buy signal from last November.

The negative seasonality of the last few months hasn’t stopped the stock market’s upward climb, and now we’re in the most bullish period of the year. Given the strong economy and moderating inflation, a continuing uptrend is likely through the end of the year. However, we’re always watching and will move toward a more cautious allocation when warranted.

Happy Thanksgiving!

Another thing AI can’t do is truly feel and express gratitude. With Thanksgiving right around the corner, I’d like to express the heartfelt gratitude that all of us at TABR feel for having you as a client. Bob, Jamie, Sylvia, and I always remember that without you, TABR wouldn’t exist. Thank you for trusting us with the things that matter most in your lives. And while I’m at it, on this Veterans Day, thank you to all of our clients who have served our country.

As always, please call or email us if you have any questions.

Best regards,

Steven W. Medland, MBA, CFP®

Partner

TABR Capital Management, LLC (“TABR”) is an SEC registered investment advisor with its principal place of business in the state of California. TABR and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisors by those states in which TABR maintains clients. TABR may only transact business in those states in which it is notice filed, or qualifies for an exemption or exclusion from notice filing requirements.

This newsletter is limited to the dissemination of general information pertaining to our investment advisory/management services. Any subsequent, direct communication by TABR with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of TABR, please contact TABR or refer to the Investment Advisor Disclosure web site (www.adviserinfo.sec.gov).

The TABR Model Portfolios are allocated in a range of investments according to TABR’s proprietary investment strategies. TABR’s proprietary investment strategies are allocated amongst individual stocks, bonds, mutual funds, ETFs and other instruments with a view towards income and/or capital appreciation depending on the specific allocation employed by each Model Portfolio. TABR tracks the performance of each Model Portfolio in an actual account that is charged TABR’s investment management fees in the exact manner as would an actual client account. Therefore the performance shown is net of TABR’s investment management fees, and also reflect the deduction of transaction and custodial charges, if any.

Comparison of the TABR Model Portfolios to the Vanguard Total Stock Index Fund, the Vanguard Total International Stock Fund, the Vanguard Total Bond Index Fund and the S&P 500 Index is for illustrative purposes only and the volatility of the indices used for comparison may be materially different from the volatility of the TABR Model Portfolios due to varying degrees of diversification and/or other factors.

Past performance of the TABR Model Portfolios may not be indicative of future results and the performance of a specific individual client account may vary substantially from the composite results above in part because client accounts may be allocated among several portfolios. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable

For additional information about TABR, including fees and services, send for our disclosure statement as set forth on Form ADV from us using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

A list of all recommendations made by TABR within the immediately preceding one year is available upon request at no charge. The sample client experiences described herein are included for illustrative purposes and there can be no assurance that TABR will be able to achieve similar results in comparable situations. No portion of this writing is to be interpreted as a testimonial or endorsement of TABR’s investment advisory services and it is not known whether the clients referenced approve of TABR or its services.