Treat It As If It Was Yours. How We Invest Our Money. Skin In The Game.

In the early 1980s, I started subscribing to many technical stock market newsletters. One of them was called The Chartist, by a guy named Dan Sullivan, out of Seal Beach, CA. Besides being a proponent of using relative strength for stock picking, he did something that I’ve never recalled anyone else in the industry doing.

He opened a brokerage account at Schwab and every time he made a recommendation in the newsletter to his subscribers, he did the exact same thing in the brokerage account. In other words, he put his money where his mouth was.

Ever since TABR was formed in 2004, and even before that, we’ve been doing the same thing. Inside, you’ll read why we think that’s important. You’ll also read about the importance of updating beneficiary forms when life situations change, the record ratios comparing large stocks to small stocks and growth stocks to value stocks, and of course, some humor.

Skin In The Game

When interviewing prospective clients during our process of discovery, and learning whether or not we’re a good fit to serve each other, we often ask people, “What do you want and expect from your financial advisor(s)?” We get a number of responses to this, but recently, one client said, “Treat our money as if it was yours.”

And that became the genesis for this month’s topic, something that perhaps Steve Medland and myself don’t emphasize enough. There are nuances, though, as to what skin in the game can mean. With investing, the implication seems to be that if the advisor or portfolio manager is investing alongside of you, doing with their money what they are doing with your money, that’s a good thing.

In fact, regarding the disclosure of fund manager ownership, the SEC argues that “a portfolio manager’s ownership in a fund provides a direct indication of his or her alignment with the interests of shareholders in that fund.” Yet, according to a study published in 2007 in the Journal of Financial Economics titled “Portfolio Manager Ownership and Fund Performance,” it was found that 57% of portfolio managers have no ownership in the funds they manage. It would seem that wouldn’t inspire a hell of a lot of confidence.

But just because an advisor might tell you they invest your money exactly like they invest their money (which is us), does that mean all is good? Not necessarily. What if that advisor doesn’t know what the hell their doing? What about their track record? Are you following the rat down the sewer?

That is why what Dan Sullivan started doing back in 1969 resonated with me—a solid track record with transparency. There’s not enough of that in our industry. If there was, I think you’d see fewer ridiculous products that are peddled to clients where the alignments are stacked to the seller, not the buyer. Things like fixed indexed annuities with 10-year or more surrender charges and prospectuses a half-inch thick that someone even with a finance background might struggle to understand.

Or real estate and other alternative investment partnerships where it’s buried in the annual report that a significant portion of the monthly yield you were told was 6% is actually a return of capital, and not cash flow from real operations. Not to mention, is there leverage being employed in real estate? In most partnerships and private funds, there almost always is leverage. How else can you offer an 8% yield in a 4% world? Simple. Leverage the balance sheet two to one.

This is why comparing real estate investments to stock/bond financial market performance is very difficult to do properly. They’re often not apples to apples. In theory, if stocks compound at nearly 10% per annum over time, all I need to do is leverage two to one, and I should earn 20% a year. Right? No. Because the sequence of returns will wipe your bum out at some point, just as it will in real estate if you have too much leverage.

Today’s latest Wall Street fad is crypto currencies. Bitcoin. Ethereum. And supposedly, hundreds of others. Are these investments? No. They’re speculative gambles, with nothing behind them other than computer codes. Never underestimate Wall Street’s ability to manufacture products to make more money for the house. Now we also have ODTE (zero days to expiration options), and fantasy sports.

Ultimately, our litmus test is simple. Would I invest any of our money in it? If not, it sure as heck isn’t going into a client’s portfolio. Our portfolios are simple, liquid and transparent. The processes we use to manage portfolios are not necessarily transparent, but that’s fairly normal in that we’re not going to give away our intellectual capital anymore than Warren Buffet is.

It helps to have 40 years of wisdom doing this. I have more wisdom than 20 years ago. And I’ve learned you don’t need all the crap I mentioned above, and much more, to achieve your financial goals. Do we have biases and conflicts of interest? Of course. The biases come with our background and prior experiences. For instance, we’ll never be a landlord and invest in rental property or commercial property or partnerships that purport to do so. No thank you. Not my thing, not my knowledge base, not my comfort level, not my expertise.

But, we do have a number of clients who are comfortable doing those things with a portion of their money. As for conflicts of interest, in our role of being a fiduciary, those are minimized, but not completely eliminated. We’ve been free of the commission world since forming TABR in 2004, and even prior at Prudential Securities, about 95% of our revenue from 1991 to 2004 came from management fees.

In my view, if advisors were required to own all of the stuff they peddle to clients, there would be a lot fewer crappy investments. In researcher Nassim Taleb’s book from 2018 appropriately titled Skin In The Game, he writes, “Skin in the game means that you do not pay attention to what people say, only to what they do, and to how much of their necks they are putting on the line.” He goes on to say, “Never trust anyone who doesn’t have skin in the game. Without it, fools and crooks will benefit, and their mistakes will never come back to haunt them.”

Today, TABR manages some $210 million of client capital, spread amongst some 230 households nationwide in 18 different states. If that collective pool of money was a mutual fund, my wife and I would be the largest shareholders. Part of that is the result of investing and saving since 1982 (and that I’m 66!), but I hope you find comfort that we’re investing alongside you with significant skin in the game. All of our staff does the same. It’s easy to be satisfied when markets are at all-time highs, as they are today. And our process is doing really well, but it will be just as important to protect capital when the market environment is not so friendly. That’s coming down the road, but there’s no reason to fret over it.

Update Those Beneficiary Forms!

This is not the first time we’ve read about a story where someone has died, and had failed to update an IRA beneficiary form, only for their heirs to find out that a form with an employer, or brokerage firm was never updated after a divorce, or breakup, and a significant sum of money is going to someone who more than likely the decedent had not intended.

In this case, according to the story in the Wall Street Journal on June 12, a man named Jeffrey Rolison dated Margaret Sjostedt in the 1980s. They broke up after about two years. Though later, Rolison lived with a new partner, Mary Lou Murray for several years, they never married, and they separated in 2014. Rolison died at 59, single and childless, but Sjostedt was named the sole beneficiary on a form provided by his long-time employer, Proctor and Gamble. As a result, Sjostedt stands to receive over $1 million from his retirement plan, unless a district court or U.S. Circuit Court of Appeals rules differently.

By the way, Rolison also died with no will and no guidance on who was to receive his home and collection of used BMWs. Rolison has two brothers. They have been fighting Proctor & Gamble in federal court to receive the money, thus far with no success. Based on past rulings, it’s unlikely they’ll win relief in the court system. The beneficiary form trumps everything. If you want to blame someone, blame Rolison. Having no estate plan and not paying attention to one’s financial affairs has consequences, and in this case, as is typical, the harm is to one’s heirs.

Unlike years ago, the vast majority of retirement plan data is online, and it’s relatively easy to log in and update beneficiary information. Paper is a thing of the past. Unfortunately, the vast majority of Americans don’t have an estate plan, let alone one that is current and working. According to surveys conducted in 2023 and earlier this year by D.A. Davidson and FreeWill, only 26% to 34% of Americans have an estate plan. Don’t be part of the percentage that doesn’t. Would you like to be cursed in your grave? Leave a mess for your heirs and you will be.

There’s more to it than just “having a Trust, or having a Will.” Assets and accounts have to be titled properly. That’s one of the whole points of having a plan. To create a Trust, and then not put proper assets in the Trust can invite the probate process, which can be tedious, time-consuming and expensive. The whole point is to avoid that situation for your heirs. Doing otherwise is simply selfish, and laziness.

Having appropriate and transparent communications with your successor trustee(s), who typically are family and/or friends, is essential. The best way to have your wishes carried out is through an estate plan, which is not a one and done “thing,” anymore than us drafting a financial plan for a client and then never updating it. An estate plan is a living, breathing document that often must be updated over time.

I’m being humble about this, but I think also truthful. Those that work with a competent financial advisor are more likely to have their stuff in order than people who do things on their own. Why? Because we will hold you accountable, until things get done. Yet, I can tell you from my over 40 years of experience, even we can’t make you drink the water.

We’ve reminded certain clients for many years on this subject to get it done, and they often procrastinate, to the point where we’ve started to offer to simply introduce them to an estate attorney and book the appointment. Even then, some of them have managed to f**k things up. There are few things in life that are certain. Death and taxes come to mind. Oh, and maybe the Angels missing the playoffs. So, for those of you in the camp of still needing to do this, in the words of comedian Larry The Cable Guy, “Get ‘er done!” Either that, or don’t die. 🙂

Respect Ratios, But Don’t Think They’re Infallible

In the last 15 years, there has been a growing disparity between the performance of large company stocks in the U.S. and small company stocks, along with the performance of growth stocks versus value stocks, and to a lesser extent, the performance of U.S. equities and foreign equities. For large vs small and growth vs value, this is in contradiction to long-term research that concluded that small stocks outperform their large counterparts over time (the small cap premium), and that value beats growth over time (popularized by David Dreman in the 1980s with the emphasis that stocks with low price-earnings ratios do better than those with high p/e’s).

Witness the charts below, courtesy of Creative Planning@Charlie Bilello and YCharts.

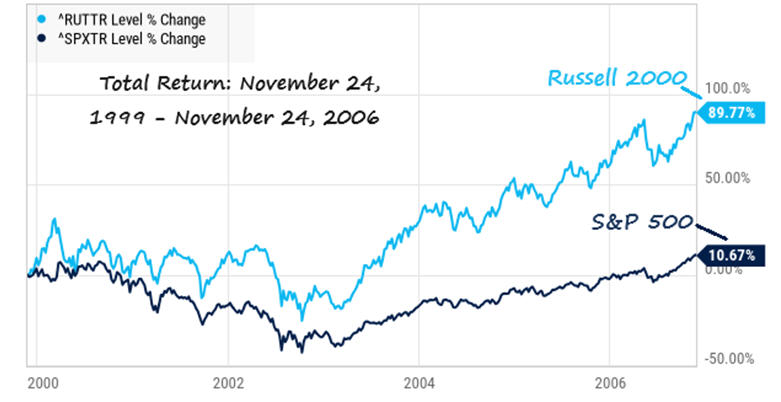

The chart above plots the ratio of the performance of the S&P 500 divided by that of the Russell 2000, a common proxy for small stock performance. Year-to-date, the S&P 500 is up 16.83%, while the Russell 2000 (IWM), has gained all of 1.09%. The last 5 years, it is 14.78% versus 6.64%. And, it’s just as bad over longer periods back to 2009. But, don’t think it will always be this way. See below.

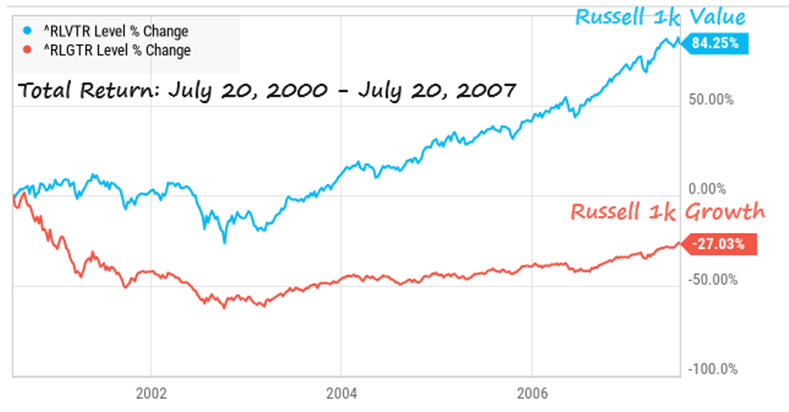

Starting at the beginning of 2000, small stocks trounced large stocks for 7 years. This coincided with the peak in the ratio between the two in 1999. This ratio has reached a similar peak now. A nearly identical setup is taking place in growth versus value. See below.

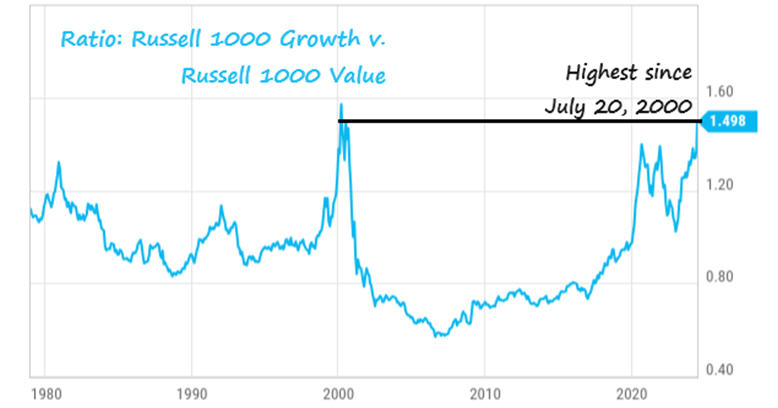

The above plots the ratio of the Russell 1000 Growth index against the Russell 1000 Value index. Again, we’re presently at the highest point in history, which was in early 2000.

Just when you thought growth would lead forever, the trend stopped, and growth got trounced for 7 years. When are these trends going to end? Heck if I know. Look at the data below, currently and for the past five years. Year-to-date, the Russell 1000 Growth Fund (VONG) has gained 23.74% while the Russell 1000 Value Fund (VONV) is up a mere 6.24%. For the past five years, the comparison is 19.33% against 8.56%. There are similar edges going back 10 and 15 years.

The long-term ratio charts suggest these trends are stretched, and should be ending. But it doesn’t mean they will. These ratios could continue rising for years before reversing. This is why our process does not rely on ratios such as these. We measure the performance of assets every month on a relative strength basis, and make changes only when the leading funds begin to lose their edge, which can take several months.

For the past year plus, we have only owned large growth funds in our tactical accounts. No small stocks, no value stocks and no foreign stocks. And it will continue that way until the evidence changes, despite our concerns about stretched valuations and concentration in the growth/technology areas. Despite today’s hype, Nvidia, Apple, Amazon, Google, Microsoft and others will not lead the stock market forever.

When the change comes, the process could be painful. But we’ll not stay on the sinking boat as it crashes. We’ll shift with the evidence, but it will not be at the top. This is also one of the big differences between our main tactical approach and our Passive Index account, which owns a bit of everything. It owns large, small, mid-caps and international and always will, and that diversification is hurting its relative performance now. That also will not be the case forever, but it’s also why Passive will always be in the minority for our recommended exposure.

Titan Capital Management 2024 Scholars

In May, I was once again blessed and honored to award scholarships of $2500 each to a few of our top graduating students in the Titan Capital Management program, that I’ve been involved with since its inception in 2011 (see below). Krystin, Blake and Jeffrey represent the best of the best, and are already moving on to wonderful opportunities.

Last Friday, I was able to see one of my favorite artists, Tim McGraw, at the Forum in Inglewood, CA. His song, released in 2016, Humble and Kind, really hooked me, and the ending lyrics really resonate.

Don’t take for granted the love this life gives you

When you get where you’re goin,

Don’t forget turn back around,

And help the next one in line

Always stay humble and kind.

Thank you, Tim.

Current Portfolio Allocations

On Tuesday of this week, one of our stock market risk models turned negative for the first time in nearly two months, so tactical equity exposure was reduced from 100% to 80%. Four of our five models remain positive, and our high yield bond tactical model remains on its November BUY signal. Overall, the evidence continues to be mostly bullish, and several indexes are at all-time highs, as are our portfolios. We’ll continue to ride the horse until it gets tired, and the evidence changes.

Material Of A Less Serious Nature

A new boss takes over at a struggling company and decides to get rid of all the slackers.

On a tour of the facilities, the boss notices a guy leaning on a wall. He can’t believe this guy would just stand around on the job. The new boss walks up to the guy leaning against the wall and asks, “What are you doing here?”

“I’m just waiting to get paid,” responds the man.

Furious, the boss asks, “How much money do you make in a week?”

A little surprised, the young fellow replies, “I make about $300 a week.”

The boss quickly gets out his checkbook and hands the guy a check made out to cash for $1200 and says, “Here’s 4 weeks pay. Now, get out and don’t come back.” The man puts the check in his pocket and promptly walks out.

Feeling pretty good about himself, the boss looks around the room and asks, “Does anyone want to tell me what just happened here?”

From across the room comes a voice. “Yeah, you just tipped the pizza delivery guy $1200.”

Haha. As has been said, if you’re the smartest guy in the room, you’re in the wrong room.

Summer is upon us. July 4. Hot Dogs, watermelon, hamburgers, and heat. Enjoy. I’m still smarting. My Dallas Stars are bridesmaids once again (like my 49ers). But there’s always hope for a sports fan. Football training camp starts in two weeks. And maybe my SF Giants will get hot in the second half. Meanwhile, if you’ve not discovered it, I highly recommend The Bear on Hulu, a 10-episode series now streaming its 3rd season. If you’re into food and restaurants, even better, but I humbly think it’s the best show on television. And if you’re looking for a comedy, just replay last week’s Presidential debate.

Best wishes,

Bob Kargenian, CMT

President

TABR Capital Management, LLC (“TABR”) is an SEC registered investment advisor with its principal place of business in the state of California. TABR and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisors by those states in which TABR maintains clients. TABR may only transact business in those states in which it is notice filed, or qualifies for an exemption or exclusion from notice filing requirements.

This newsletter is limited to the dissemination of general information pertaining to our investment advisory/management services. Any subsequent, direct communication by TABR with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of TABR, please contact TABR or refer to the Investment Advisor Disclosure web site (www.adviserinfo.sec.gov).

The TABR Model Portfolios are allocated in a range of investments according to TABR’s proprietary investment strategies. TABR’s proprietary investment strategies are allocated amongst individual stocks, bonds, mutual funds, ETFs and other instruments with a view towards income and/or capital appreciation depending on the specific allocation employed by each Model Portfolio. TABR tracks the performance of each Model Portfolio in an actual account that is charged TABR’s investment management fees in the exact manner as would an actual client account. Therefore the performance shown is net of TABR’s investment management fees, and also reflect the deduction of transaction and custodial charges, if any.

Comparison of the TABR Model Portfolios to the Vanguard Total Stock Index Fund, the Vanguard Total International Stock Fund, the Vanguard Total Bond Index Fund and the S&P 500 Index is for illustrative purposes only and the volatility of the indices used for comparison may be materially different from the volatility of the TABR Model Portfolios due to varying degrees of diversification and/or other factors.

Past performance of the TABR Model Portfolios may not be indicative of future results and the performance of a specific individual client account may vary substantially from the composite results above in part because client accounts may be allocated among several portfolios. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable

For additional information about TABR, including fees and services, send for our disclosure statement as set forth on Form ADV from us using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

A list of all recommendations made by TABR within the immediately preceding one year is available upon request at no charge. The sample client experiences described herein are included for illustrative purposes and there can be no assurance that TABR will be able to achieve similar results in comparable situations. No portion of this writing is to be interpreted as a testimonial or endorsement of TABR’s investment advisory services and it is not known whether the clients referenced approve of TABR or its services.